Business Insurance in and around Philadelphia

One of Philadelphia’s top choices for small business insurance.

Helping insure businesses can be the neighborly thing to do

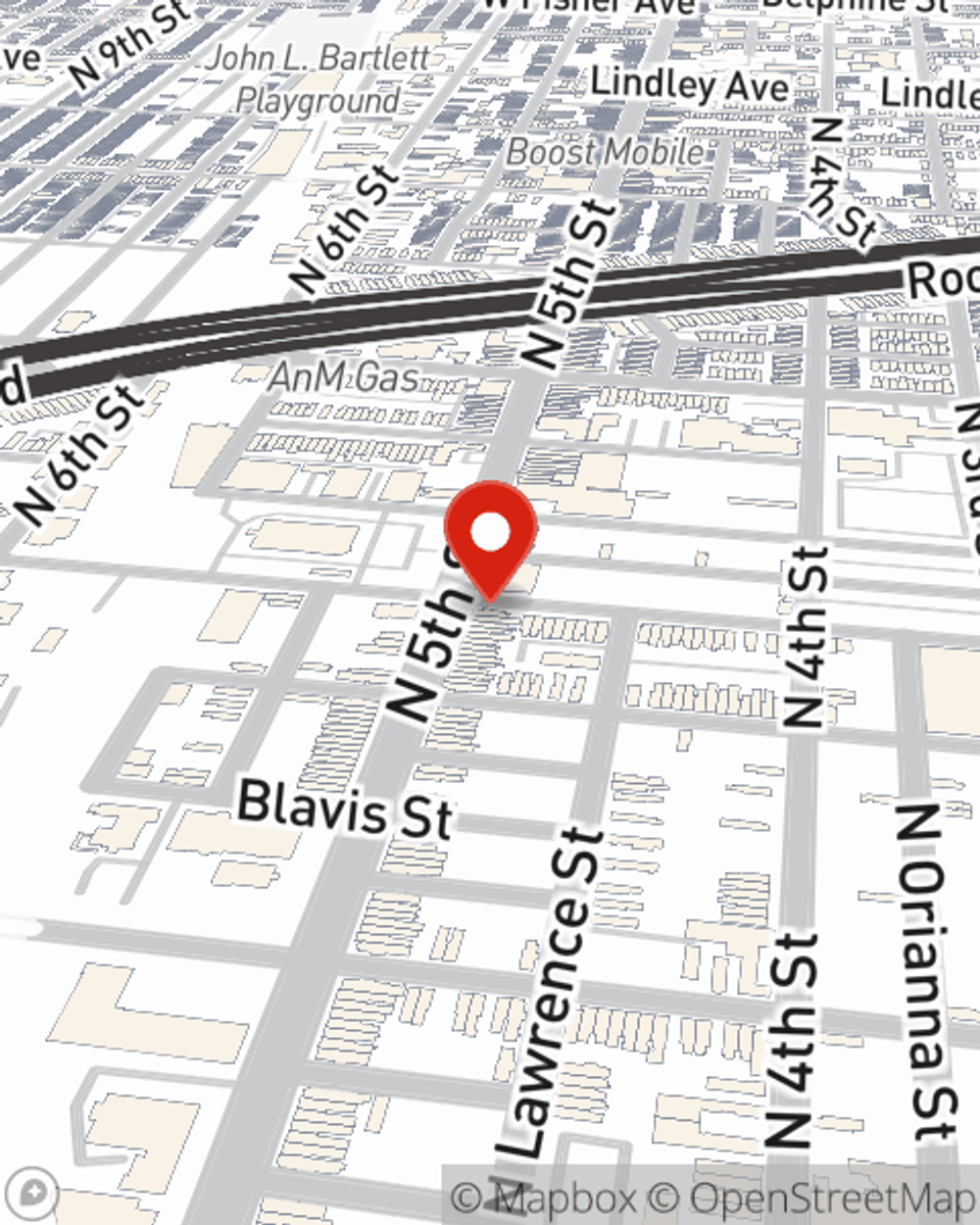

- Olney Logan Fern Roc

- Logan

- Fern Rock

- Hunting Park

- East Germantown

- Frankfort

- West Kensignton

Help Prepare Your Business For The Unexpected.

You've put a lot of elbow grease into your small business. At State Farm, we recognize your efforts and want to help insure you and your business, whether it's a cosmetic store, a tailoring service, a fabric store, or other.

One of Philadelphia’s top choices for small business insurance.

Helping insure businesses can be the neighborly thing to do

Keep Your Business Secure

Your business thrives off your commitment passion, and having great coverage with State Farm. While you do what you love and lead your employees, let State Farm do their part in supporting you with worker’s compensation, commercial liability umbrella policies and artisan and service contractors policies.

As a small business owner as well, agent Stalin Vasquez understands that there is a lot on your plate. Get in touch with Stalin Vasquez today to discover your options.

Simple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.

Stalin Vasquez

State Farm® Insurance AgentSimple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.